How to write a complaint that neighbors rent housing

There is no strict form of the document, but there are several necessary details:

- Name of the applicant himself, address of residence;

- the exact address of the object to be rented;

- essence of the question;

- evidence of illegal residence;

- request for the application of measures of influence in relation to violators.

The proof that the room is being rented can be the noisy behavior of the residents, the violation of order in the house.

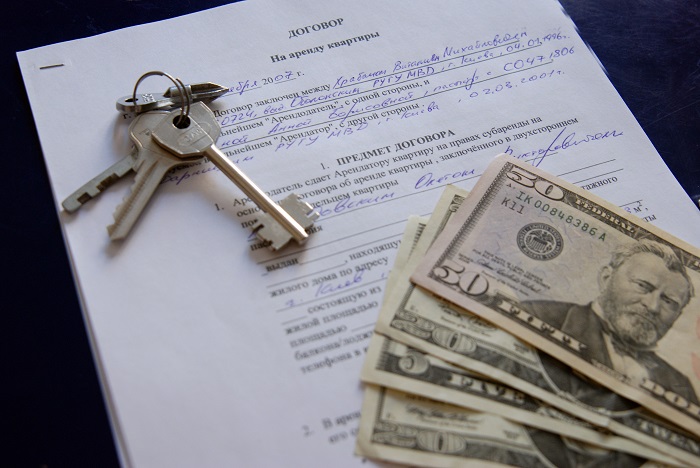

A more compelling argument is a contract of employment and confirmation of the transfer of funds. But such documents remain only with temporary residents.

What can the tax authorities do if there is no evidence of a violation? They will consider the complaint and call the owner of the property for a private conversation. Employees of the fiscal department have the right to summon unscrupulous taxpayers. This possibility is provided by 4 p. 1 art. 31 of the Tax Code.

The inspectors will not be able to go to court without evidence. Unfounded statements and denunciations are not accepted by the court. There are no documents on income - it means that it is absent. The rental agreement is not proof that the homeowner actually made a profit.

If you write about renting out an apartment, you can get on the nerves of your neighbors.

Is it possible to rent a room without the consent of the neighbors

The owner has the right to dispose of the property at his own discretion. But his rights may be limited by the rights of other citizens.

Therefore, the need to obtain the consent of the neighbors before renting out the living space directly depends on the premises itself:

- A room in a communal apartment - no permit required. Each object is a separate room in the possession of a specific owner. Therefore, each of the owners has the right to independently dispose of their property.

- A room in an apartment that is in shared ownership - renting an object is prohibited. Shared ownership is considered ideal. Therefore, a citizen does not have rights to a specific room. He can use the entire apartment as a whole, but does not have the right to rent a room.

- A room in an apartment, with the definition of the right of use - the room can be rented out with the consent of the co-owners. As a rule, they do not give such consent.

- Part of the apartment allocated in kind - the consent of the co-owners is not required. From the moment of allocation in kind, the object is considered an independent object of ownership. The owner does not depend on the opinion of co-owners.

- Separate apartment - you do not need to obtain the consent of the neighbors.

Application to the tax office for illegal renting an apartment

Info

The transfer of property for trust management does not entail the transfer of ownership to the trustee, who is obliged to manage the property in the interests of the owner or a third party specified by him.

- the Constitution of the Russian Federation (Article 17);

- "Rules for the use of residential premises" (paragraphs 6-10);

- Federal Law "On the sanitary and epidemiological welfare of the population".

When writing the main part of the application, it is important to indicate:

- the address of tenants or tenants who violate the rules of the hostel;

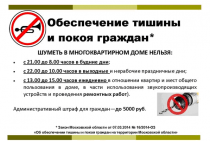

- a specific list of violations (systematic noise at night, causing harm to the common house territory);

- impact measures.

An example of writing the main part:

Statement

We, the signatories below, ask you to take action on the fact of periodic violations of public order by residents renting an apartment at the address: Saransk, st. Centralnaya, d. 8, apt. 25 with bringing them to administrative responsibility.

List of violations:

- living in an apartment is carried out without temporary registration and a lease agreement, which is confirmed by the tenants themselves.

- Smoking in the hallway.

- Listening to loud music, fights and brawls at night.

These violations are contrary to the requirements of Art.

What documents to provide

To prove illegal income from doing business and the fact of non-payment of taxes, any documents related to the provision of services and the sale of goods will do. These can be civil law contracts, checks, invoices and receipts. In case of harm to health from unauthorized trade, medical certificates can be attached to the complaint. As a supporting document, you can add advertisements in newspapers or screenshots of electronic offers for the provision of services. If you filed a complaint with the head of a company engaged in illegal activities, you can attach a copy of this document.

An official appeal to the tax office is carried out in three ways:

- On the site ru.

- Sending an application by mail.

- Personal visit to the IFTS.

There is no statutory application form, but there is an algorithm for entering the necessary data.

Before complaining about illegal business activities, it is advisable to collect reliable information about:

- whether the person is an individual entrepreneur or LLC, if it is registered;

- legal address and actual place of business;

- coordinates of the tax office.

The application should have the following structure:

- introductory part - the so-called hat;

- meaningful;

- resolutive.

In the upper right corner, you must indicate the name of the Federal Tax Service Inspectorate where the application is submitted, as well as information about the applicant (name, address of registration and actual place of residence). If a legal entity applies, then data on its legal address, TIN, PSRN and KPP must be provided.

Many are afraid of publicity and want to apply anonymously, without disclosing personal data. However, an anonymous request to the tax office is not officially subject to consideration.

Where to report illegal business activity anonymously? To do this, there is a helpline of the Federal Security Service, which receives information about suspicions and facts of violation of the law without leaving contact details.

The content of the application describes the circumstances of the discovered offense:

- Who conducts illegal business.

- In what area of business.

- Be sure to indicate the systematic nature of this activity with a description of the work schedule.

- What legal norms are violated by the identified violation.

- State the details of the incident: date, time, address, presence or absence of witnesses.

- Describe the attached documents.

The operative part contains the applicant's requirement to take specific measures against the violator. It is advisable to provide a phone number for feedback.

Responsibility for illegal business in Russia is still quite mild. Perhaps it is this fact that drives entrepreneurs when they begin to conduct activities illegally. But you need to remember that the time will come to pay the bills.

>Looking for help: where to complain if a neighbor rents an apartment and does not pay taxes, as well as a sample application to the tax office for download

Possible consequences of illegally renting an apartment

Renting out real estate is often aimed at generating additional income. Currently, scammers and swindlers who want to profit from an inexperienced landlord are very active.

The most popular types of scams are:

- Releasing a rented apartment without the consent of the owner. The situation is very relevant if the owner has moved to another region and rarely comes to his hometown. An unscrupulous tenant simply provides housing to other people for profit, but no one knows who they will turn out to be.

- Criminal actions with real estate on the basis of forged documents.

You can protect yourself from such tenants by signing an employment contract containing personal information about a citizen, his place of permanent employment, etc.

It happens in a different way: the necessary papers are drawn up, the terms and amounts are agreed, the owner regularly pays visits. It would seem that there should not be any difficulties ... But, no one is immune from damage to property. Even if the apartment was rented without furniture, windows, plumbing, chandeliers, etc. can be damaged. You can save property with the help of insurance and the act of acceptance and transfer, which is drawn up upon delivery of housing.

You can negotiate with a responsible and conscientious tenant, but four-legged and feathered roommates are another pitfall for providing an apartment to third parties on a lease basis. You can try to protect yourself from such a problem by describing the restriction in the contract.

Failure to submit a declaration that includes the amount of income received from the rental of housing may result in the imposition of fines, penalties, and in some cases criminal prosecution.

Where to complain about the illegal rental of an apartment in Moscow

Providing housing to third parties without proper registration is an illegal act. In the capital of our country, renting apartments is a very common and profitable business.

A neighbor or the tenant himself (for example, in the presence of a conflict situation) can submit an application to the tax authority (at the place of registration of the owner of the apartment). The complaint can be accompanied by receipts for the transfer of money on account of the monthly fee, receipts for the purchase and repair of various household items, utility bills, etc. A citizen can personally come to the tax office and submit a package of documents or send papers by mail.

Moscow attracts everyone with good salaries and great opportunities. Among the guests of the capital you can often meet migrants from other countries. They prefer to settle in large groups (in order to save money), which often disturbs the peace and comfort of their neighbors. In such a situation, you should visit the Moscow Migration Service, which will find out the legality of the stay of foreigners and the purpose of their arrival.

All cases of non-compliance with the regime of the day and other violations of peace should be reported to the district police officer or the police should be called.

To whom to complain

There are several options for whom you can report that your neighbors are breaking the law.

- Management Company. Her task is to control the observance of order in the house.

Ideally, the director of the Criminal Code should report the “grey” lease to the fiscal department and notify the migration service about tenants living without a residence permit. If the result is not followed, you need to complain further.

- Precinct.

You can write a statement to the police station. The task of the police is to respond to messages from residents and call violators to order. For violations, the precinct may issue a fine. The amount of recovery is from 1500 to 2500 rubles.

Recovery established h.1 with. 19.15 Administrative Code. If it turns out that temporary residents do not have registration or personal documents are not in order, then a signal will be given to the tax authorities and the Main Department of Internal Affairs of the Ministry of Internal Affairs (formerly the FMS).

- GUVM MIA. Visitors from other states cannot reside in the Russian Federation without registration.

You can try to resolve such troubles amicably with the landlord (perhaps he was not aware of the tenant's occupation) or contact the district police officer.

Neighbors rent an apartment for rent how to deal

For example, call an outfit right at the moment of scandalous behavior, so that the guests are checked right at the time of the violation.

In this case, the owner of the apartment may be called, who will be issued an administrative fine in case of repeated violations of the order.

Living near such apartments can really be dangerous, so you need to unite and resist a bad apartment.

If measures are not taken, then after contacting the police, you can complain to the prosecutor's office. The statement of several people, which indicates that strangers come to the apartment and bring various objects, should alert the police and lead to a thorough check.

Eviction procedure

If during the check illegal immigrants of foreign origin are found, then representatives of the Federal Migration Service will evict them immediately after revealing this fact.

Tenants who have a Russian passport will have to be evicted in court and a lawsuit filed against the owner of the rented apartment.

That the application was accepted by the court for consideration, it should not be unfounded, but contain veils and evidence of violations of the passport regime.

He will be responsible for the actions of the tenants.

When the court decision is made and the money is paid, the owner of the apartment has the right to direct penalties to the persons who directly caused the damage.

When providing premises for rent, a person must understand all the risks associated with settling tenants. Some people prefer to compensate for the fact of their appearance by raising the rent. If the rights of other residents of an apartment building are infringed, a legal assessment may be carried out by judges or other bodies.

Having decided to go to court, neighbors should try to collect as much evidence as possible of the guilt of the owner of the property and tenants.

It is important to supplement the application with a list of documents. You can attach a copy of the appeal to the district police officer, a documented certificate and other official acts

It is important that as many neighbors as possible apply to the authorized body. You can increase your chances of making a positive decision by contacting an experienced lawyer.

This will also have a positive effect on the chance of winning the case.

Renting an apartment for a day

The fact of a constant change of tenants may indicate that the premises are rented for a short time

Before contacting other authorities, it is important to find out whether it is possible to rent an apartment in a residential building

Sample application to the tax office for illegal renting of an apartment

Often the relationship ends with the fact that the owner forces the tenants to move out earlier than the due date and does not return the deposit.

In this case, the tenants can take revenge on the owner if they “snitch” on him to the tax office.

2 proofs of illegal rental of housing:

- hire agreement;

- receipts on receipt of funds by the owner of the apartment.

If the illegal rental of an apartment is proven, the owner of the living space will face negative consequences.

Penalties. The tax inspectorate will oblige the owner to pay tax for the entire time of renting out housing, accrue penalties, issue a fine

Attention

Its size is 20% of the outstanding amount.

Increased penalties for repeat offences. If repeated violations are found, the amount of the penalty increases

The rule is established by Art. 122 of the Tax Code of the Russian Federation. You will be fined additionally for not filing your tax return on time. The collection will be from 5 to 30% of the amount of hidden tax.

Criminal liability.

Large profits obtained illegally mean large fines for the violator. Responsibility is established by Art. 198 of the Criminal Code. The violator will be fined from 100 to 300 thousand rubles. Instead, a citizen who rented out housing can be arrested for 6 months or sent to corrective labor for up to one year.

Income from renting expensive real estate may exceed 1.5 million rubles.

What is the illegal rental of an apartment and the general situation in the rental property market

Illegal renting of an apartment is one of the most common problems in the residential and commercial real estate market today. Legal rental of housing involves compliance with the following rules, regulated by the laws of the Russian Federation:

- Payment by the owner of taxes on the income that he receives from this transaction.Renting out real estate is a profitable business, and owners often do not want to share income with the state treasury. However, the laws of the Russian Federation define the rental of housing as one of the types of entrepreneurial activity and oblige the entrepreneur to pay 13% to the state budget.

- Registration of the tenant on the meters of living space rented to him.

In case of illegal surrender, both rules are violated, which entails administrative and criminal liability on both sides. Such illegal business is exacerbated by the fact that a foreign citizen lives in a rented premises.

Trends that can be traced in the rental property market:

- Renting luxury residential space almost always takes place in the legal field: the owners of such housing do not conduct illegal activities, they regularly deduct the due payments to the state treasury.

- Economy class housing owners, seeking to reduce all kinds of expenses, conduct illegal activities, hiding the fact of residence of tenants.

- About 80% of all concluded transactions for the lease of residential premises (as a rule, economy class) are made illegally.

Neighbors rent an apartment by the day how to deal

To evict citizens of the Russian Federation from a rented apartment, you will have to suffer. Since this procedure can be carried out only by decision of the judicial authorities. It should be noted that in most cases the decision is not in favor of the plaintiff. Even if the apartment is rented illegally. The thing is that in addition to a claim against noisy neighbors, a good evidence base must be collected.

The neighbors are unhappy with the tenants.

what to do?

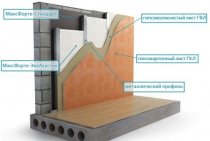

Careless handling of the apartment, which can lead to its damage and loss of residential condition. An example of such careless treatment can be:

- Prolonged failure to carry out current and major repairs in the apartment, which can lead to an emergency condition and become a threat to other residents.

- Regular refusals from offers of other residents of the house to carry out joint repairs of structural elements of the house, for example, roofs, etc.

- Unauthorized (without appropriate approvals from permitting authorities) restructuring or redevelopment of a dwelling, which may pose a threat to the integrity of the building.

- Untimely elimination of the emergency state of engineering communication systems and other equipment of the apartment.

In such cases, the homeowner must warn the tenant of the inadmissibility of such violations and demand their elimination.

How to evict neighbors who rent an apartment

In a word, they make the life of the residents unbearable.

It is recommended to involve other neighbors in writing the application.

Having received an appeal from citizens, the district police officer will report on how to fight for the unfair use of the apartment. So, advice can be given about calling the outfit directly at the moment of scandalous behavior.

Attention

This will cause the occupants of the premises to be checked at the time of the violation. The police have the right to call the owner of the apartment

Important

If a violation is found, in repeated cases an administrative fine is issued. Living near such a room leads to additional risks.

Therefore, experts advise to unite in the fight against the unfair use of the apartment.

If the police still do not take action, you can file a complaint with the prosecutor's office. It is better to make an application from several people at once.

It is necessary to record in the document that strangers constantly come to the apartment and bring various items. This may alert the police. As a result, a thorough check will be carried out.

Consequences of illegal lease transactions

The situation when neighbors illegally rent an apartment is very common in the territory of the Russian Federation. The circle of people involved in this "scam" (consciously or accidentally) receives a lot of risks and troubles. For instance:

- The owner of housing, who rents it out without registering a business activity and without buying a patent, de facto violates the law: hides sources of income and evades taxes. For such a violation, a fine is imposed, at least. Periodic raids by law enforcement agencies, together with the tax police, often reveal violators of the law. And if you rent housing illegally, think about the consequences.

- The tenant has practically no rights and is obliged to leave the apartment at the first request of the owner, since he is not protected by anything. There are absolutely no guarantees that the landlord will not “throw out” the tenant from the apartment a week after the settlement. Where to complain to the tenant in such a case? And nowhere, because he himself is to blame for this. Yes, an official deal will increase the rent by 10-15%, but if you suddenly have to change your place of residence (for example, because of the bad temper of the landlord), then the services of a broker, moving and settling in a new place will cost many times more. A formal contract gives the tenant confidence that his complaint in the event of the owner's willfulness will be treated with full responsibility.

- Other residents of the apartment building also suffer from similar illegal transactions. Firstly, the tenants may turn out to be illegal migrants (of 6-10 people), because of which the neighbors can only dream of peace. Secondly, informal renting allows tenants to engage in questionable activities, which will also affect those who live nearby. Thirdly, many illegal residents allow themselves to be careless about the cleanliness and order in the entrance, since they are not responsible for this.

In such a situation, it is not surprising that many people have a desire to fight neighbors who rent residential meters illegally. No one has the desire to pay with their own peace and comfort for neighborly financial ambitions. In any situation, you can seek legal advice by phone free of charge.

How to write an application to the tax office about the illegal rental of an apartment

If tenants complain about renting an apartment without a contract, this complicates the entire proof procedure.

After the appeal, the tax authority will conduct an audit. This is the most effective way to detect possible violations. It is carried out on the basis of a decision of a competent official.

Important

In the course of these actions, all violations committed by an unscrupulous landlord will be identified.

There are several types of checks. An in-house audit based on a complaint to the tax office concerns those documents that the taxpayer (and in this case, the landlord) is required to provide.

An on-site inspection following a tenant's complaint about illegal renting is a procedure in which the inspector works on the territory of the landlord, checking contracts, documents that are related to financial and economic activity. The taxpayer will not have the right to interfere with all procedures, so the chances that violations will be detected are very high.

In case of violations, certain sanctions will be applied to the landlord.

The landlord is obliged to submit a declaration of his income to the tax office every year.

It is also worth deviating a little from the topic and saying that very often his neighbors can suffer from the actions of the landlord. For example, from violations of public order, etc. They can also file a complaint with the tax office, but this will not end with anything other than the visit of an inspector. Why this situation arises will be explained below. If the neighbors suspect the landlord of renting the apartment to citizens illegally residing on the territory of the Russian Federation, then residents can complain to the migration service (UFMS) about the tenants and the owner of the apartment.

You should start with the fact that, as a rule, only the tenant himself can prove the existence of such a transaction.In addition, he will need to provide evidence, such as: bank statements that confirm the constant money transfers to the landlord.

Before taking decisive action and starting to file various complaints, it is worth talking with the landlord and trying to convince him not to break the law and start paying taxes, however, this will not always have the proper effect on the latter.

How to write an application to the tax office about the illegal renting of an apartment sample

Since new neighbors, as a rule, celebrate holidays in such apartments, it is natural that this is not to the liking of people living in neighboring apartments.

To begin with, before complaining to the authorized bodies, you need to make sure that the residential premises are rented for exactly one day.

For this, it is allowed:

- Capture on a video or photo that new tenants enter the apartment every day.

- In cases where public peace or order is violated in the apartment next door, the police should be called.

- When clarification of relations or violations are carried out at the entrance, it is recommended not to hesitate to record violations on video.

After all the evidence of the daily rent of a residential facility has been collected, it is necessary to contact the police.

It is permissible, at the same time as contacting the police, to inform the tax office about renting an apartment.

Violations when renting an apartment

If citizens have problems with a neighboring rented apartment, then it is necessary to warn the owner about upcoming inspections and complaints addressed to him. A person must understand that he immediately violates two important laws: the tax and migration codes

Sometimes it is enough to draw the attention of a neighbor to stop the outrages behind the wall. Now cases of household gas explosions are not uncommon, which should be paid attention to by the owner

The vast majority of landlords do not pay income tax and do not issue temporary registration for their tenants. Neighbors are loyal to the appearance of tenants, but only as long as it does not affect their interests. Therefore, if the landlord calls the district police officer or neighbors and demand to evict tenants forcibly and not create inconvenience to citizens, you should immediately agree.

There are many legal ways to punish significant violations; neighbors can turn not only to the police, but to competent lawyers. The consultation will tell you how to punish the perpetrator and what should be done to evict tenants without breaking the law. The owner himself should not be in conflict with his neighbors, and when he settles a detachment of foreign workers, even for a short period, he should warn the tenants about possible troubles.

How to write an application to the tax office about the illegal renting of an apartment

This method is rarely resorted to - as a rule, the issue is not brought to court.

To go to court, it is necessary to prove that the plaintiff has taken all possible steps to resolve the conflict without involving the body. What exactly will be the basis for satisfying the claim?

- Repeated calls to the police, confirmed by copies of employee reports.

- Contacting SES. The confirmation will be a copy of the conclusion of the commission.

- A collective complaint indicating violations from residents of an apartment building.

- Systematic flooding, fires due to the fault of residents, as well as other actions that caused damage to property. This will be confirmed by documents from the HOA and the management company.

If you need to go to court, consult with a real estate lawyer.

How to prove and what evidence is needed

The tax service specialist, who went to check on the complaint, seeks to find an agreement on the provision of square meters to a third party and prove that the relationship has a material basis. If it was not the tenant who came with the complaint who had the document, then it would be very difficult to achieve the desired result.

You can act independently or involve the precinct. Representatives of the law usually act as follows: they pay a visit, collect information about a potential employer through their “sources”, etc.

After establishing the fact that outsiders are in the apartment, the tax inspectorate begins to collect evidence indicating that the relationship is compensatory, that is, it finds out how much profit the landlord receives. In accordance with paragraph 12 h. 1 Article. 31 of the Tax Code of the Russian Federation, the owner of the property and the tenant may be invited to give evidence. The landlord may also be a suspect if a criminal case has been opened against him (for example, Article 198 of the Criminal Code of the Russian Federation).

Attention

Art.

We will help find a solution to your problem for free - just call our legal adviser by phone:

+7 (499) 350-80-25 (Moscow)

+7( 812) 627-15-68 (St. Petersburg)

It's fast and! You can also quickly get a response through the consultant form on the website.

If the owner ignores these requirements, he may be held administratively liable. Penalties include two payments:

- For not transferring tax payments (Article 122 of the Tax Code of the Russian Federation).

The amount of the fine is up to 40% of the amount of unpaid tax.

- For failure to submit a declaration (Article 119 of the Tax Code of the Russian Federation). The penalty is 5% of the amount of unpaid tax for each month.

In this case, the fine cannot be less than 1000 rubles.

If the requirements of tax legislation are repeatedly ignored by the owner, and the amount of debt to the Federal Tax Service amounted to more than 900 thousand rubles. within the last three years, the landlord may be held criminally liable. This is provided for in Art. 198 of the Criminal Code of the Russian Federation.